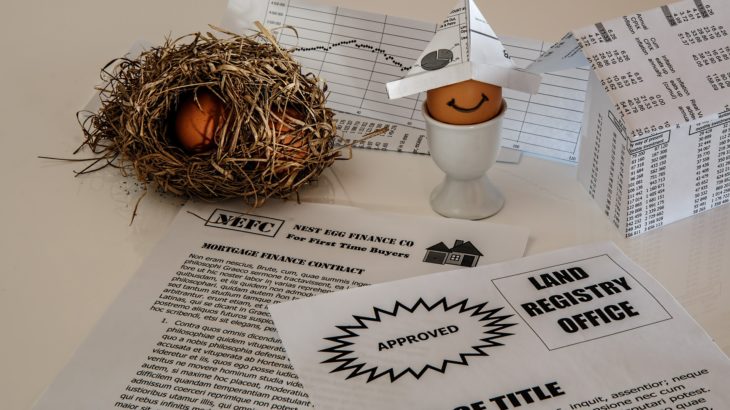

Who Needs Conveyancing?

Whether you are selling, remortgaging a house or are a first-time buyer, you will need conveyancing provider. Since conveyancing can be one of the most complicated parts of the moving process, read this post to find out things you can expect about the process before undertaking conveyancing.

What Is Conveyancing?

Short answer? It is a legal process whereby the ownership of a property is transferred from one party to another. Depending on where you are from, anyone can act as a conveyancer – even the seller themselves. Other countries or state requires that the conveyancing provider be registered or licensed.

Regardless of whether you are allowed to act as a conveyancer on a property purchase or not, remember that it’s not a straightforward process. Conveyancing includes carrying out various checks into the property’s ownership and other factors that could have a bearing on your rights and responsibilities as the new owner. Unless you are experienced in this, it might be better to leave it specialist property lawyers.

How Long Does Conveyancing Take?

With the conveyancing process requiring the completion of several tasks, it is common to experience a few delays along the way. Generally, though, the conveyancing process can take up to 12 weeks to be completed. For a clearer picture of how it works, keep reading. You’ll find below a breakdown of the procedure:

Phase One:

Step One: You will have to get the contract pack. This is handled by the conveyancing provider you hire. They will get in touch with the seller’s solicitor to obtain the pack.

Step Two: You will have to wait for your offer on the property to be approved. Once it is approved, you can move to the next step.

Step Three: Have the valuer of the inspect the property.

Step Four: Get approved for a home mortgage loan.

Step Five: Hire a regulated Chartered Surveyor. The surveyor will conduct a survey.

Step Six: Your conveyancing provider to get you your mortgage offer. They will be responsible for requesting and obtaining that offer.

Step Seven: All compulsory local authority searches will have to be conducted. This is typically taken care of by the conveyancing provider.

Step Eight: Once theconveyancing provider has the contract pack, your mortgage offer and the results from local authority searches conducted, they will compile the data, analyse it and come to you with all relevant details.

Step Nine: Review the information presented to you. Ask questions if necessary and the provider will provide additional clarification if necessary.

Step Ten: At this Step, the conveyancing provider will also ask you what’s your targeted completion date.

Step Eleven: Discuss completion dates with the mortgage provider and confirm the dates which you think will be more convenient.

Step Twelve: Once the date is confirmed the conveyancing provider will relay the same to the seller’s conveyancing provider. If necessary, they will also negotiate on your behalf.

Step Thirteen: If you are sure about everything in the contract and you are agreeable to the terms, you can sign it before returning it to the solicitor.

Step Fourteen: Contact Chartered Surveyors and ask for quotes. These are free and you can request to get them instantly.

Step Fifteen: The seller’s solicitor will have to be informed if you want to proceed with the exchange of contract. This task will fall to your conveyancing provider.

Step Sixteen: Send the deposit to your conveyancing provider

Step Seventeen: Once the contracts have been signed, the conveyancing provider will exchange them with the seller’s conveyancing provider.

Step Eighteen: The conveyancing provider will send the deposit payment you made to the seller’s conveyancer.

Phase Two:

Step One: After completion of all the steps in phase one, the conveyancing provider will send you a completion statement.

Step Two: Your conveyancing provider will carry out all necessary searches.

Step Three: Arrange for building insurance. (The conveyancer will probably tell you to arrange for it at this stage.)

Step Four: The transfer deed will be prepared by the conveyancing provider.

Step Five: Sign and return the transfer deed to your conveyancing provider.(Remember to study the deed carefully before affixing your signature on the document.)

Step Six: The signed transfer deed will be sent to the seller’s conveyancing solicitor by your conveyancer.

Step Seven: Request finances from your mortgage lender (also done by the conveyancing provider)

Step Eight: The payment for the house will be transferred to the seller’s conveyancing provider by your own conveyancer.

Step Nine: Your conveyancer will collect title and transfer deeds. If there were any outstanding mortgages, they will also receive documentation proving that these have been redeemed.

Step Ten: Once you’ve collected the keys and moved into your new home, the conveyancer will despatch the transfer deed to the Stamping Office and despatch other documents to HM Land Registry for the registration of your ownership of the property.

Step Eleven: After having received the title deeds from HM Land Registry, the conveyancer will remit the same to your mortgage lender.